| How To Guides > Military Lending Act Configurations |

In order to be in compliance with the Military Lending Act, institutions are required to identify applicants that are considered a Military Covered Borrower and include a Military APR (MAPR) calculation for all of their non-credit card accounts. The MAPR calculation must include any credit insurance premiums and fees for debt cancellation or debt suspension agreements, as well fees for credit-related ancillary products, such as GAP and MBD. Within the Loan Origination module, MAPR is calculated for all close-ended loans, but system administrators are provided with the functionality to identify the applications where MAPR should be applied, automatically include fees and/or non-loan cross-sells in the MAPR calculation as well as validate that the MAPR does not exceed 36% of the standard APR, which is a stipulation set by the Military Lending Act.

|

For information on calculations including Military APR, please see the Save and Calculate section of the Loan Terms topic in the User Guide. |

Additionally, as of Fall 2016, the Military Lending Act requires that a military status check is performed during the application process to confirm that the applicant is actively serving in the military or reserves, or is an immediate family member of an active duty account holder. Financial institutions can review an applicant's military status by performing an MLA Search through a credit report or as a stand-alone request. Rules can then be used to set the Military Covered Borrower field to indicate the applicant's military status.

This topic provides administrators with an overview of the configurations that need to be made in order to capture and display MAPR information and covered borrower status during the application process.

The following items are required for completion while configuring Temenos Infinity to support the MAPR component of the Military Lending Act:

The following fields are available to be added to a screen in System Management > Origination > Screens in order to capture and/or display information for the Military APR calculation:

|

The fields listed below are also available to add to rules, reports, and views. |

| Field | Screen Type | Field List Path | Description | ||||

| Military APR | Application screen | Application > Military APR |

Displays the value of the MAPR returned from the loan calculator.

|

||||

| Military APR Total Fees | Application screen | Application > Military APR Total Fees |

Displays the total amount of fees included in the MAPR (interest, fees, payment protection) that is returned from the loan calculator.

|

||||

| Military Covered Borrower |

Applicant screen Applicant panel on an Application screen |

Application > Applicants > Military Covered Borrower |

Iidentifies that the applicant is considered a covered borrower under the Military Lending Act.

|

The following two fields are available to be configured in rules, reports, and views:

The following section provides an overview of the logic used to author a rule that adds a fee included in the MAPR calculation as well as author a rule to validate that the MAPR does not exceed a specific amount.

To begin authoring rules, navigate to System Management > Origination > Rules Management and click  to open Rules Manager.

to open Rules Manager.

|

There are many ways to author a rule, therefore, the information below should be used as an example ONLY. For a complete overview of the rule configuration process, please see the Rules Management topic in the Administrator Guide. |

Using the Add a Fee or Add a Fee (Home Equity) action templates, rule authors are able to automatically add fees to an application during application initialization, when an application is decisioned and as part of the Calculate process.

The rule vocabulary in these templates provides the ability to automatically set values for the fee being added, including whether or not the fee should be included in the MAPR calculation.

To begin authoring a rule to add a fee, create a new business rule using the Fees category and Application Entity.

|

For more information on authoring a Fee rule, please see the Add a Fee Vocabulary Template Example in the Administrator Guide. |

When authoring the Then Statement, select one of the following fee templates:

| Template | Rule Vocabulary |

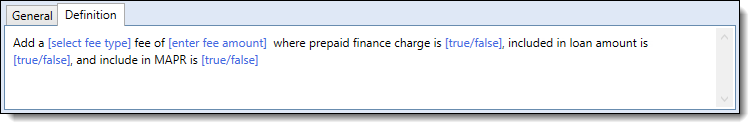

| Add a Fee |  |

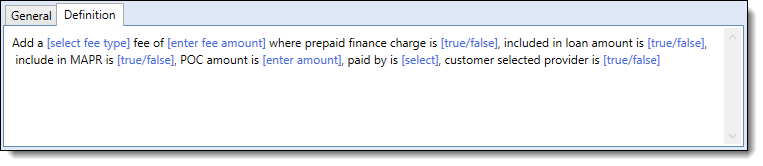

| Add a Fee (Home Equity) |  |

To automatically include a fee in the MAPR calculation, set include in MAPR to true within the rule template.

|

Fees can also be manually included in the MAPR calculation by setting the Included in MAPR field to true in the Fees panel. For more information, please see the Fees Panel topic in the User Guide. |

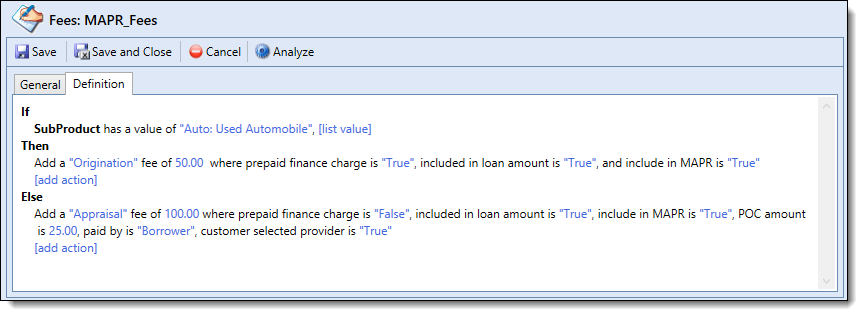

The example below provides a demonstration of a rule that adds a fee included in the MAPR calculation to an application based on the Sub-Product:

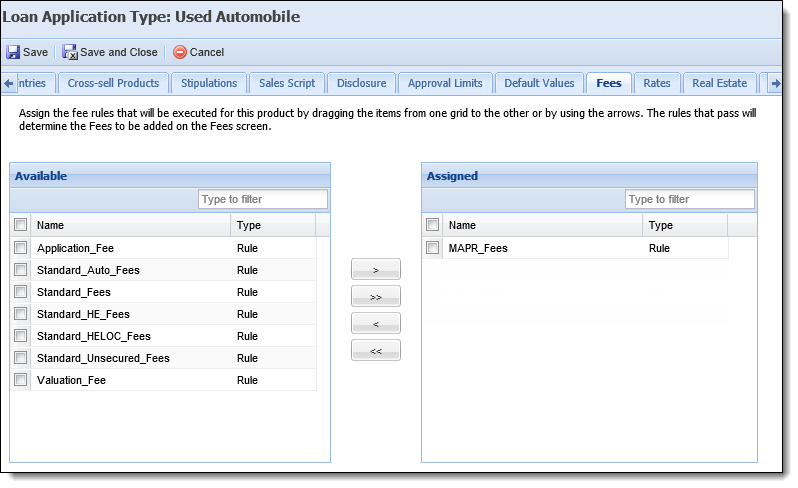

After a Fee rule is created and saved to the rule application, it can be assigned to the desired application type within the Fees tab in Loan Application Types (System Management > Origination > Loan > Loan Application Types).

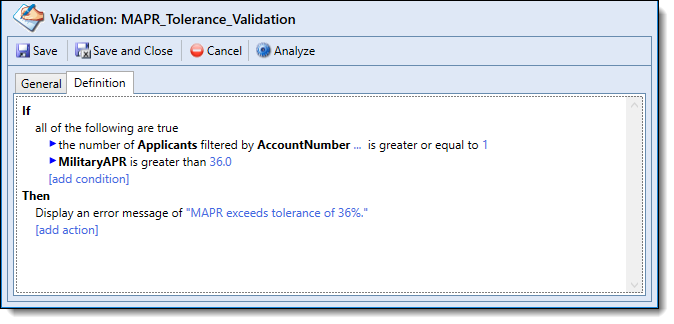

A Validation rule must be authored to ensure that the MAPR for a qualifying application does not exceed 36% of the standard APR.

To begin authoring a rule to validate that the MAPR does not exceed this threshold, create a new business rule using the Validation category and Application Entity.

The example below provides a demonstration of a Validation rule that displays an error message when the Military APR exceeds the 36% threshold on an application:

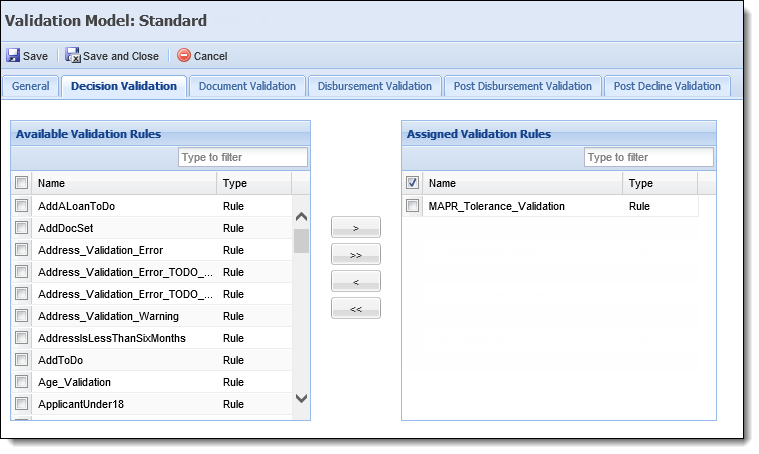

Once a Validation rule is created and saved to the rule application, it must be assigned to a Validation Model in System Management > Origination > Validation Models.

|

The Military APR can be validated at any stage of the application, however, It is recommended to assign the Validation rule to the Decision Validation or Document Validation process. |

|

After the Validation rule is assigned to a Validation model, the Validation model including the rule must be assigned to a Loan Application Type in order for the rule to execute during the application process.

For more information, please see the following topics in the Administrator guide: |

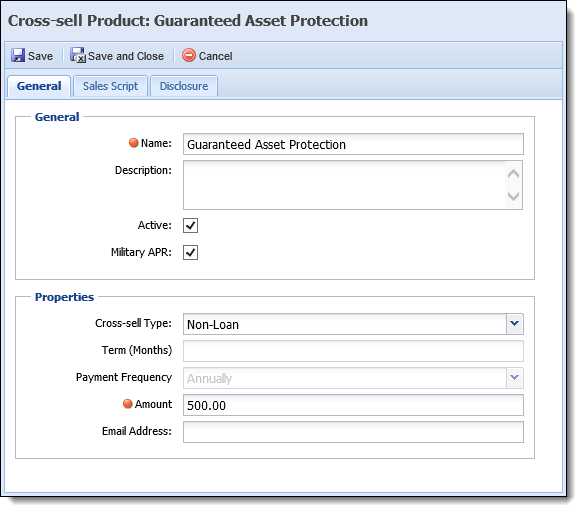

From the Cross-sell Products page in System Management, administrators can configure non-loan cross-sell products to be included in the Military APR calculation for a close-ended loan.

|

Only Non-Loan cross-sell products can be included in the MAPR calculation. |

To include non-loan cross-sell products in the MAPR calculation:

to retain the settings.

to retain the settings. |

For more information on configuring Cross-sell Products, please see the Cross-sell Products topic in the Administrator Guide. |

The following items are required for completion while configuring Temenos Infinity to support the MLA search component of the Military Lending Act:

Additionally, this section contains the following MLA search configuration tips:

Prior to configuring Temenos Infinity for MLA searches, the following steps must be performed and information from each of the financial institutions active credit bureaus must be obtained:

A separate test Subscriber Code is not required.

Military status search functionality is only supported using the Full File Fixed format.

A separate test Subscriber Code is not required.

Stand-alone military status search functionality currently not supported by TransUnion.

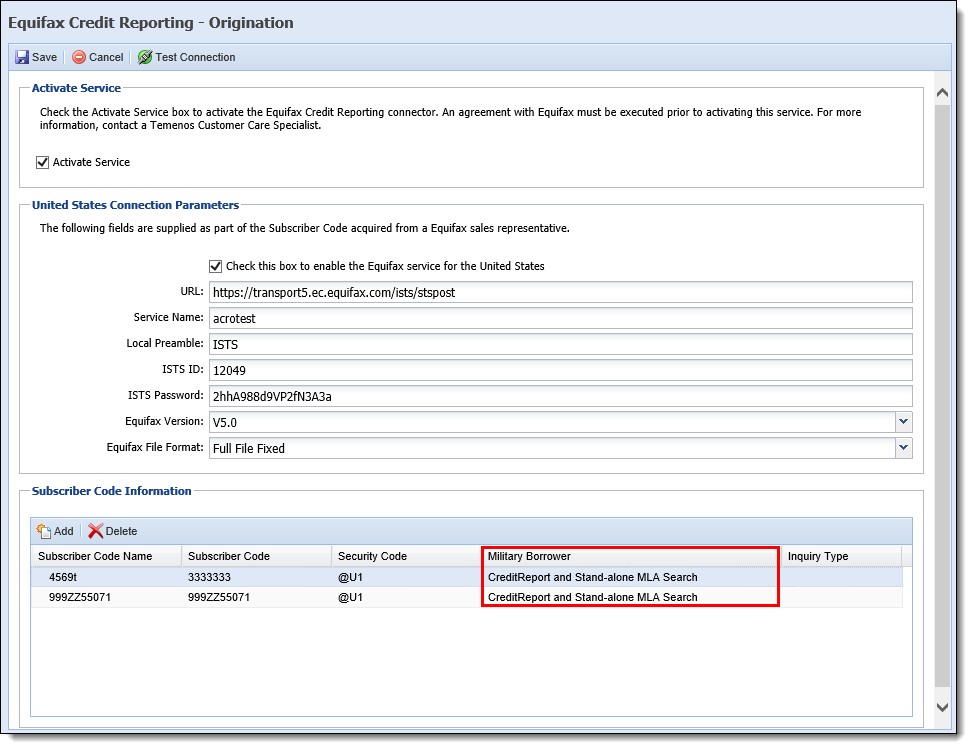

The Equifax, Experian, and TransUnion Origination connectors support the MLA searches used to obtain an applicant's military status. The financial institution has the option to include MLA searches in standard credit reports, perform MLA searches separate from credit reports (stand-alone), or through both the credit report and stand-alone methods. These options provide an institution with the ability to easily incorporate the MLA search requirement into their own unique business processes.

To configure MLA searches for the credit bureau connectors, navigate to the respective connector page in System Management > Connectors and select an option from the Military Covered Borrower Check parameter, for each Subscriber Code.

The following options are available for selection:

| MLA Search Option | Description |

| Credit Report | Select this option to include the MLA status check in credit reports and to prohibit stand-alone MLA searches from being performed. |

| Credit Report and Stand-alone MLA Search | Select this option to include the MLA status check in credit reports and to enable stand-alone MLA searches. |

| None | Select this option to exclude the MLA status check from credit reports and to prohibit stand-alone MLA searches from being performed. |

| Stand-alone MLA Search | Select this option to exclude the MLA status check from credit reports and to enable stand-alone MLA searches. |

Once an MLA search option is selected and the connector page is saved, an applicant's military status can be checked from within Temenos Infinity.

|

For more information on the Equifax, Experian, and TransUnion connector pages, as well as details on how MLA searching works for a specific credit bureau, please see the respective connector guide. |

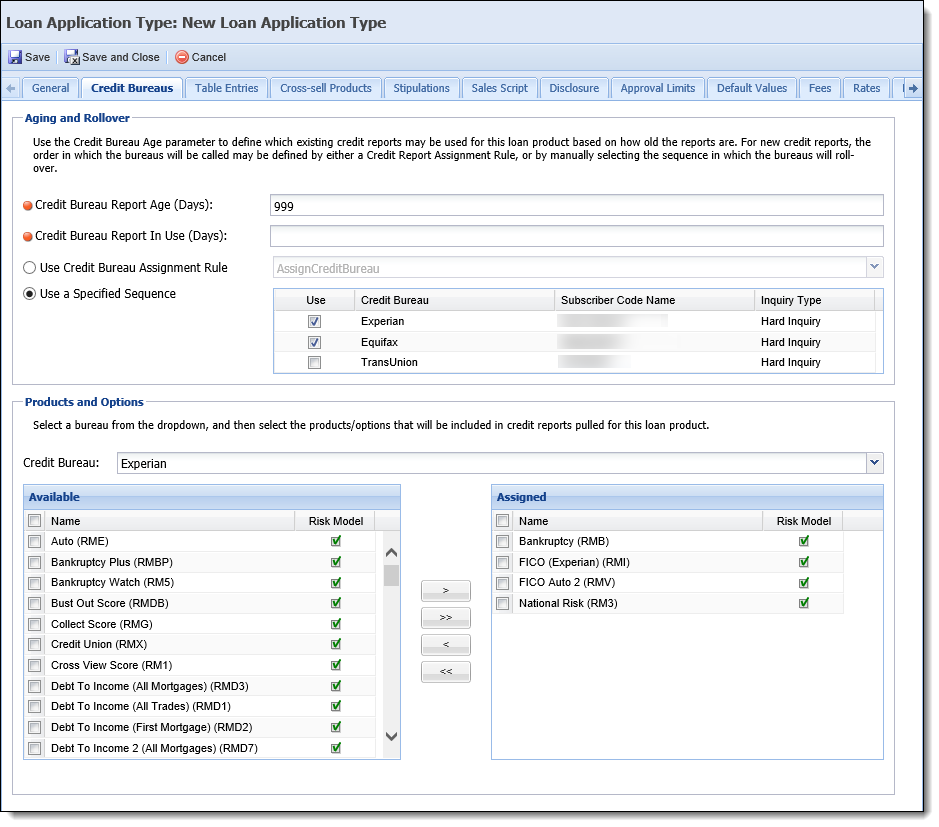

In order to perform MLA Searches within an application, the MLA enabled Subscriber Code must be assigned to the applicable Loan or Account Application Types within System Management > Origination > Loan > Loan Application Types or System Management > Origination > Account > Account Application Types. In each Application Type, select the Credit Bureau tab, and choose the MLA enabled subscriber code using the Subscriber Code Name parameter.

|

The values in the Subscriber Code Name drop-down populate from the credit bureau's connector page. |

The following fields are available to be added to a screen in System Management > Origination > Screens in order to display information for the applicant's military status:

|

The fields listed below are also available to add to rules, reports, and views. |

| Field | Screen Type | Field List Path | Description | ||||||||||||||||||||||||

| Military APR Loan | Application screen | Application > Military APR Loan | Identifies that the loan has one or more Military Covered Borrowers. | ||||||||||||||||||||||||

| Military Status Check Date |

Applicant screen

Applicant panel on Application screen |

Application > Applicants > Military Status Check Date |

Displays the date the military status check was performed.

|

||||||||||||||||||||||||

Military Borrower Status

|

Applicant screen

Applicant panel on Application screen |

Application > Applicants > Military Borrower Status |

Displays the covered borrower status retrieved from the credit report or stand-alone MLA search as follows:

|

||||||||||||||||||||||||

| Is Override MLA Status |

Applicant screen

Applicant panel on Application screen |

Application > Applicants > Is Override MLA Status | Identifies that the military status obtained from a credit bureau has been overruled, such as when the applicant has no credit history, and therefore is not in the credit bureau's database, or if the credit bureau's DOD database is incorrect. |

The following fields are not available in screens, views, or reports but are available for use in rules:

| Field | Description | ||||||||||||||

| Applicant > Credit Bureau Info > Credit Bureau Product |

Displays the product code to identify the bureau and product as follows:

|

||||||||||||||

| Score > Address Alert | Displays the address alert associated to the credit score. | ||||||||||||||

| Score > Consumer Statement | Displays the consumer statement associated to the credit score. |

The Request MLA Search Only action enables the stand-alone military status search to occur automatically behind-the-scenes after a certain event, such as a field change, occurs. When configured in System Management > Origination > Event Processing and fired, the Request MLA Search Only action performs a military status search for the applicant according to the credit bureau use order configured for the loan application type, and for those credit bureaus where the Military Covered Borrower Check connector page parameter is set to Stand-alone MLA Search or Credit Report and Stand-alone MLA Search.

|

The Credit Bureau use order is configured with the Use a Specified Sequence parameter on the Credit Bureaus tab for each sub-product in System Management > Origination > Loan > Loan Application Types. |

|

The Request MLA Search Only action cannot fire if the Military Covered Borrower Check connector page parameter is set to Credit Report only for all bureaus. |

After the MLA status is retrieved for the applicant through the Request MLA Search Only action, the results can be viewed on the Credit Reporting screen.

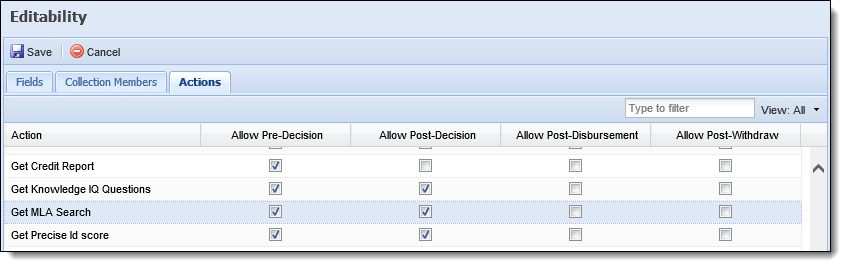

By default, the Get MLA Search action within System Management > Origination > Editability is set to Allow Pre-Decision and Allow Post-Decision, but can be changed if it is desired for this action to be performed at other times during the application process.

|

For more information on configuring Editability actions, please see the Editability topic of this guide. |

Under the Military Lending Act, any applicant on active military duty, on orders or immediately related to someone on orders or active duty is considered a Military Covered Borrower. The Military Covered Borrower field provides institutions with the ability to identify that an applicant meets the requirements to apply the MAPR to an application. When a financial institution determines that an applicant is a Military Covered Borrower through credit reporting, an Event Processing rule can be authored to automatically set the value of the Military Covered Borrower field based on information in the credit report.

To begin authoring a rule to set the value of the Military Covered Borrower field, within Rules Manager, create a new business rule using the Event Processing category and Applicant Entity.

|

There are many ways to author a rule, therefore, the information below should be used as an example only. For a complete overview of the rule configuration process, please see the Rules Management topic in the Administrator Guide. |

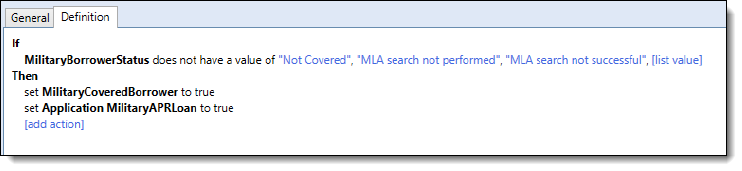

When authoring the If statement, define the conditions that must be met in order for the Military Covered Borrower field to be set to true.

When authoring the Then statement, use the set the value of a field action template to set the following:

The example below provides a demonstration of a rule that sets the value of the Military Covered Borrower and the Military APR Loan flags to true based on the applicant's military status indicated on the credit report:

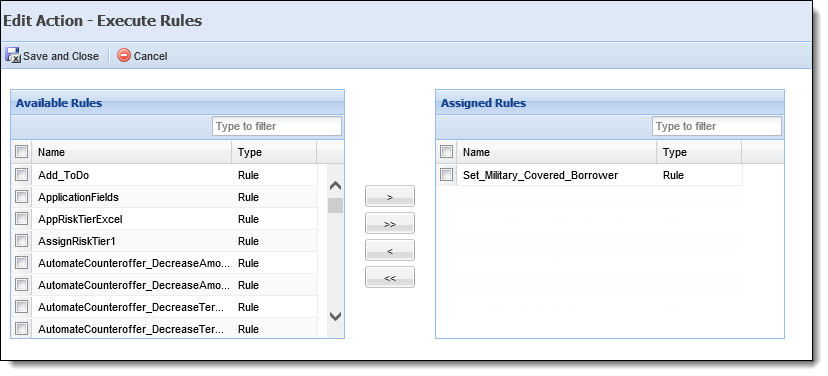

After an Event Processing rule is created and saved to the rule application, an Event/Action pair with the following properties must be configured in System Management > Origination > Event Processing to execute the rule when a credit report is pulled during decisioning:

|

For more information on configuring Event/Action pairs, please see the Event Processing topic in this guide. |

Because military status searches can be incorporated into a financial institution’s current business processes in several different ways, this section highlights how Temenos Infinity can be configured to support MLA searches in two common business scenarios.

|

These scenarios and configurations are for example only. |

The financial institution desires to include military status searches in each credit report, and wishes to provide users with the ability to request an MLA search at a later date, if necessary.

| Temenos Functionality | MLA Configuration |

| Credit Bureau Connector Page |

Set the Military Covered Borrower Check parameter to Credit Report and Stand-alone MLA Search.

|

| Event Processing |

|

| Rules | Assign a Validation rule to validate MAPR tolerance. For example, MAPR tolerance can be validated during document generation. |

The financial institution desires to pull credit and perform MLA searches as separate processes.

| Temenos Functionality | MLA Configuration |

| Credit Bureau Connector Page |

Set the Military Covered Borrower Check parameter to Stand-alone MLA Search.

|

| Event Processing |

|

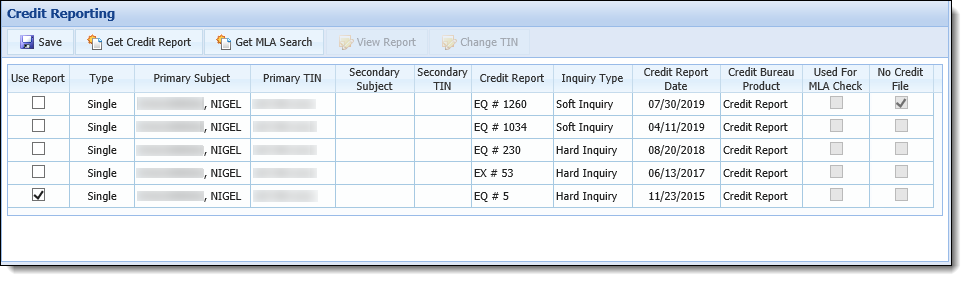

In addition to military status searches being performed automatically through Event Processing, searches can also be performed manually through the Credit Reporting screen. Depending on the configuration of the credit bureau connector pages and the functionality available for the requested bureau, the Credit Reporting screen provides users with the ability to execute manual stand-alone MLA searches, as well as the ability to pull credit reports that contain MLA statuses.

The Credit Reporting screen contains the following buttons that enable users to perform credit report and MLA search functions:

| Button | Description |

|

This button provides users with the ability to pull a credit report that also includes an applicant's military status information, if the Military Covered Borrower Check parameter on the connector page is set to Credit Report or Credit Report and Stand-alone MLA Search. |

|

This button provides users with the ability to obtain the applicant's military status information without pulling a credit report, if the Military Covered Borrower Check parameter is set to Credit Report and Stand-alone MLA Search or Stand-alone MLA Search. |

|

This button provides users with the ability to view an existing credit report or results of a stand-alone military status search. |

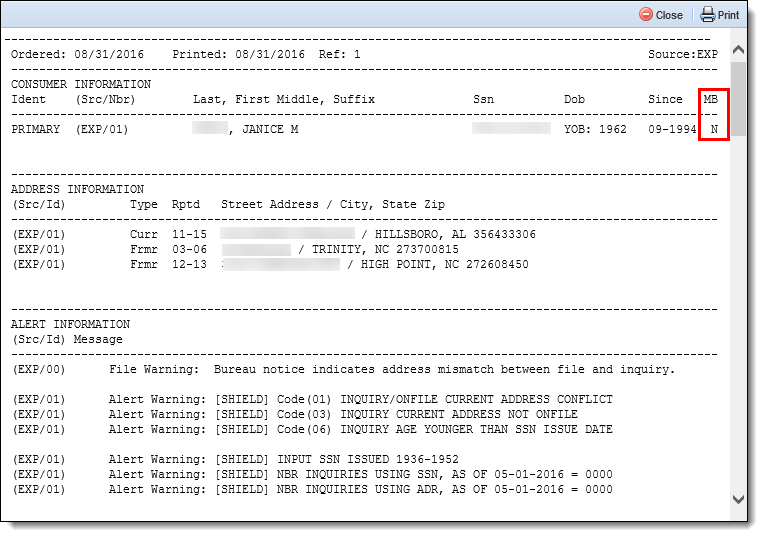

Once a credit report containing military status information is pulled, or an MLA search is performed, the applicant's military status displays in the last column (MB) of the Consumer Information section in the report. The value that populates in the MB column corresponds to a value from the MILITARY_BORROWER_STATUS lookup field in Temenos Infinity. For example, in the report below, an N appears in the MB column, which indicates that the applicant is not a covered borrower.

Reference the table below for an overview of the Military Borrower Status that corresponds to each possible value for the MB column in the viewable credit report.

| Value in MB Column on Credit Report | Applicant Military Borrower Status |

| N | Not Covered |

| Y |

Depending on the credit bureau(s) used to pull the credit report, a “Y” in the MB column indicates one of the following Military Borrower Statuses:

|

| U | MLA search not performed |

| E | MLA search not successful |

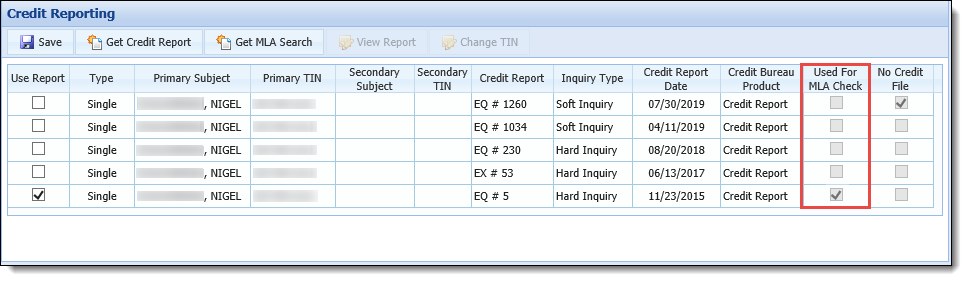

If a credit report is used to perform a MLA Search, the Military Status Check Date field is set for the applicant when the report is pulled. When this date is set, the CreditReportHistoryID from the credit report is stored in the database, and the check box in the Used for MLA Check column is set to true for the corresponding report in the Credit Reporting screen.

This column is a read-only field that provides the ability to quickly identify the most recent credit report used to perform a MLA check, and set the MLA Covered Borrower Status field for the applicant.

|

The Used for MLA Check column is the only location in Temenos Infinity that provides the ability to view which credit report was used to perform a MLA Search. |

|

For more information on the Credit Reporting screen and the MLA search functionality contained therein, please see the Credit Reporting Screen topic in the User Guide. |